The interconnected nature of the economy illuminates the fascinating relationship between two critical aspects – mortgage interest rates and inflation. The constant ebb and flow of these economic elements fuel the dynamics of the financial world, impacting not only homeowners and buyers, but also the wider national economy. A grasp of such intricacies forms the foundation of financial literacy, empowering individuals for prudent decision-making. This journey takes us through the basic understanding of these economic phenomena, their historical interplay, an in-depth analysis of their relationship, and their potential future trajectories.

Table of Contents

Understanding Inflation and Mortgage Interest rates

Unraveling the Core Principles of Mortgage Interest and Inflation Rates: A Confluence of Economics and Finance

Understanding the foundational tenets of mortgage interest rates and inflation is a fascinating journey into the realm of macroeconomics and modern financial theories. These principles serve as critical lynchpins, bolstering the structure and functioning of the global economy. Each nuance constitutes a cog in the vast machinery of the economic cycle, and comprehensive comprehension of these, paves the way towards strategic financial decisions.

To begin with, mortgage interest rates are a consequential element in the real estate market and epitomize the cost of borrowing capital. When an individual or entity seeks to purchase a property but lacks the full amount, they often turn to financial institutions for a loan, termed a mortgage. The payment for utilizing this service arrives in the form of mortgage interest, delineated as a percentage of the borrowed sum.

One might wonder, on what basis these rates are determined? At its core, the answer lies in the symbiosis of supply and demand, credit risk, and macroeconomic indicators. Lenders assess the borrower’s creditworthiness, which signifies their ability to repay the debt. The riskier the borrower, the higher the mortgage interest rate. Equally substantial are indicators like inflation, which undeniably exert influence on interest rates.

In essence, inflation reflects the rate at which the general level of prices for goods and services is rising, thereby eroding purchasing power. A moderate increase in inflation is symptomatic of economic growth. However, an unexpected surge can create havoc in financial markets, leading to an increase in mortgage rates. Herein, the role of central banks is pivotal. These institutions modulate national interest rates to maintain price stability, often increasing the interest rates during high inflation. This manipulation influences the cost of borrowing for banks, which then percolates down to the consumers in the form of revised mortgage rates.

Elucidating further, the relationship between mortgage interest rates and inflation is intrinsically woven. Essentially, as inflation rises, the dollar’s value decreases. Consequently, lenders demand higher mortgage interest rates as compensation for the loss in purchasing power of the money they will be repaid in the future. Thus, an intricate balance is sustained where mortgage rates tend to increase with rising inflation.

In sum, the principles of mortgage interest and inflation rates are essentially a complex interplay of individual financial behavior, institutional policies, and macroeconomic conditions. Recognizing the complex dynamics at work in these systems can foster informed financial decision-making and bolster comprehensive economic understanding. By unearthing these fundamental principles and the delicate equilibrium maintained among them, we unveil the intriguing world of contemporary finance and economics, illuminating not just the path for prospective home buyers but also for individuals keen to decipher the economic cycles that punctuate our lives.

Historical Perspective of Mortgage Interest and Inflation

Historical Insights: The Relationship Between Mortgage Interest and Inflation

Delving into the shared history of mortgage interest rates and inflation reveals an intricate tapestry of fluctuating monetary policy, financial stability, and economic cycles. An examination of varied eras provides a clear view of how these two critical economic concepts have been intrinsically intertwined.

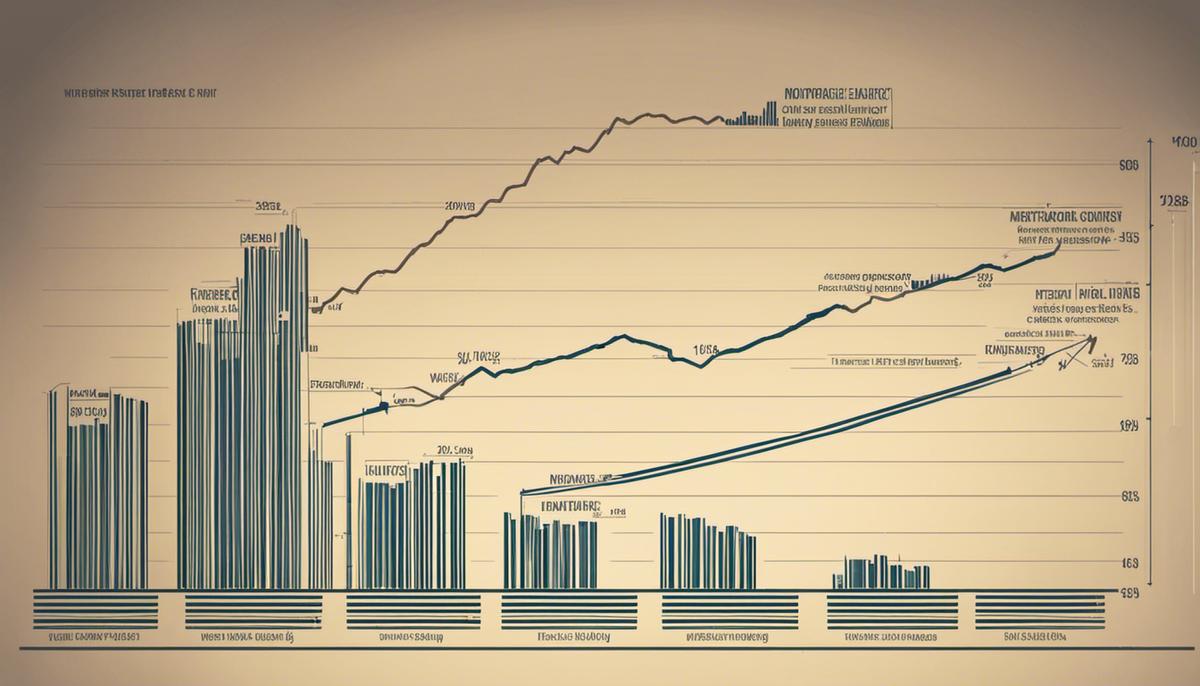

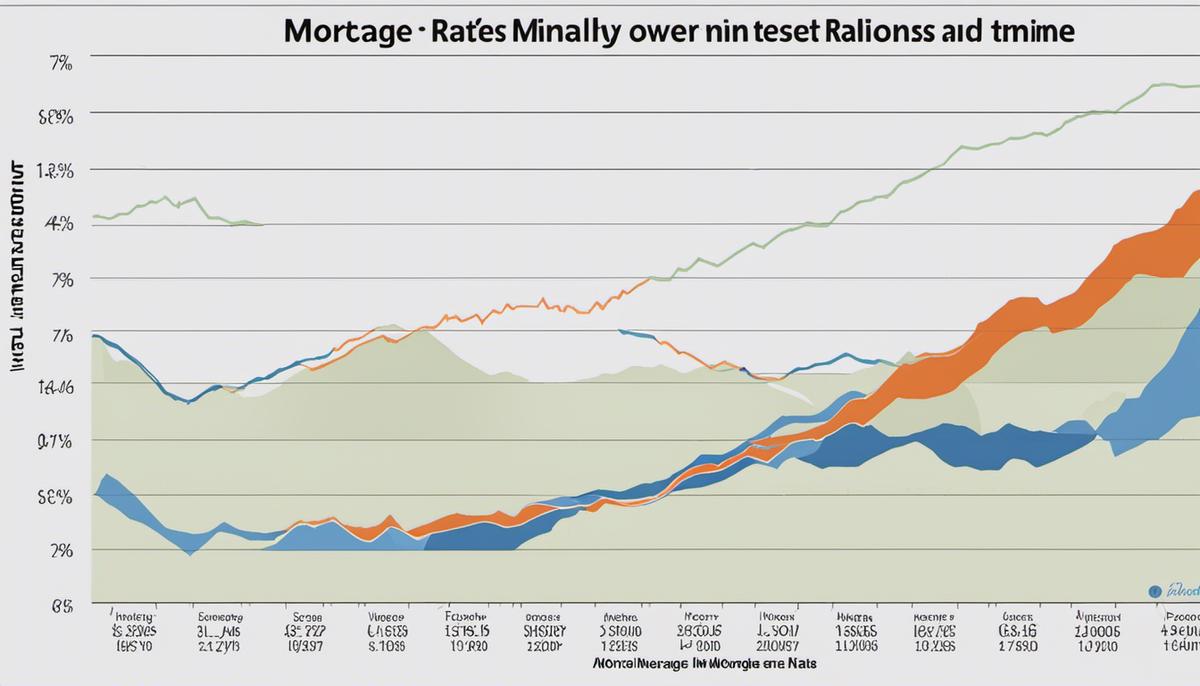

A prominent instance is the period of the late 1970s and early 1980s, often referred to as the legacy of the Volcker Shock. Amidst severe inflationary pressures, the Federal Reserve—directed by Chairman Paul Volcker—raised the Federal Funds Rate dramatically, causing a subsequent spike in mortgage interest rates. This move, while initially causing economic discomfort, successfully squeezed out inflation and triggered a reevaluation of the relationship between mortgage rates and inflation.

Fast forward to the early 1990s, where an era of lower inflation was ushered in by steady central bank policies, leading to a period of general economic growth. With lower inflation expectations, the benchmark interest rates adopted a more subdued attitude, mirrored in the reduction of mortgage interest rates. This demonstrates the counterbalancing nature of the relationship between inflation and mortgage rates – in periods of lower inflation where the economy is growing steadily, mortgage rates are often lower, resulting in a conducive atmosphere for real estate investments.

Shift then to the financial crisis of 2008, an indelible event shaping central bank policies worldwide. The immediate aftermath saw a significant drop in inflation, accompanied by an equally stark decrease in mortgage interest rates. This plunge, engineered by central banks’ aggressive rate reduction tactics, aimed to stimulate the housing market recovery and, indeed, the broader economy. This scenario provides insight into how adjustments in the relationship between mortgage interest rates and inflation can be leveraged as a response to financial crises.

Consider now the current era, one marked by the challenge of historically low inflation, despite expansive monetary policies. Amid this seemingly paradoxical landscape, mortgage rates have also scraped record lows. Scrutinizing this milieu provides a striking understanding of the effects prolonged low inflation rates can have on mortgage lending.

Clear patterns emerge from these historical episodes illustrating how shifts in inflation and deflation can lead to a synchronized swing in mortgage interest rates. Yet the predictive power of this relationship is not invincible. Numerous factors including financial innovation, central bank’s shifting policy preferences, expectations of consumers and investors, and geopolitical issues all add layers of complexity onto this nexus.

The relationship between mortgage interest rates and inflation is like a grand symphony of economic experience – sometimes harmonious, sometimes discordant, always complex. This interplay paints an enthralling picture of the power of central banks, the resilience of financial markets, and the enduring linkages between individual households and the broader economic context. With every new economic phase, we continue to unravel and appreciate the intricacies of this relationship, expanding our comprehension of the dynamic world of economics. A deeper understanding of this connection not only fosters better individual decision-making capabilities regarding housing investments but also aids in the formulation of effective economic policies and strategies.

Analyzing the Relationship between Mortgage Interest and Inflation

Continuing this exploration, an often-observed aspect is how central banks, such as the U.S. Federal Reserve, adjust key policy rates in response to inflationary pressures. This has an interesting echo effect; namely, it influences mortgage interest rates. This underlines the correlation between behavioral economics and macroeconomic policy, drawing on the fundamental premise of the Keynesian economic philosophy.

To delve deeper, an intriguing aspect to consider is the role played by consumer and investor expectations within the systems mechanics of the correlation between inflation rates and mortgage interest rates. Essentially, these expectations set rhythm to the economic pulse. The way individuals perceive future inflation impacts not only their consumptive behaviors but also the determinant outfits within the credit market system – namely, mortgage lenders.

Analogously, consider the process of inverted yield curve phenomenon. When investors expect future inflation to fall, a demand boost for long-term bonds ensues, resulting in lower long-term interest rates. This instigates pressure on the mortgage lending market to adjust interest rates likewise. In counter perspective, when future inflation is perceived to rise, investors shift to short-term bonds, easing the demand for long-term bonds. This culminates in a rise for long-term interest rates, thereby “upshifting” mortgage rates.

This winding dance between inflation and mortgage rates takes another twist in the arena of financial innovation. Over the years, new financial instruments and lending mechanisms have spawned, allowing more flexibility to consumers and faster responsiveness to macroeconomic indicators by lenders. This has blurred some of the more classical relational expectations between inflation and mortgage rates, further emphasizing the vital role informed decision-making plays.

Geopolitical issues also factor into this economic symphony. Unforeseen events or policy changes at an international scale can nudge inflationary expectations either way — such as trade wars or oil price shocks — sparking ripples that play out within domestic mortgage lending markets.

Now, one might wonder, why this meticulous attention to the interplay between mortgage interest rates and inflation rates? It’s the realization that these rates, moving co-dependently in intricate patterns, echo the ebb and flow of economies, housing markets, and by and large, life circumstances of countless individuals. These individuals, if empowered with an understanding of the correlates and underpinnings, can drive their own financial futures more effectively.

Despite the undergrowth of inherent complexity and uncertainty, the correlation between mortgage interest rates and inflation rates unveils a marvel of economic orchestration. It underlines the need for continuous learning, analysis, and adaption – at the individual, institutional, and policy-making echelons.

Such considerations offer a refreshing perspective on the entwining dynamics of these key economic indicators. They illuminate why each pull and push in this financial tug-of-war presents another varyingly hued strand in the rich tapestry of economic theory and practice.

The Future Projection: Mortgage Interest and Inflation

Anticipated Future Dynamics Involving Mortgage Interest Rates and Inflation

Future trajectories involving mortgage interest rates and inflation are notoriously complex and unpredictable. They are susceptible to a delicate balance of factors that include, but are not limited to, shifts in political climate, novel central bank strategies, and advancements in financial technology. These factors necessarily involve an elevated level of uncertainty, given their unpredictability and the intricate way they interweave with different elements across the global economy.

In the upcoming chapters of this fiscal narrative, central banks’ policy adjustments will undoubtedly continue to shape the relationship between mortgage interest rates and inflation. Innovations in policy-making, both reactive and preemptive, hold potential to orchestrate new dynamics in this complex interplay. Novel methodologies and strategies may be imposed to balance inflation rates, sometimes requiring the alteration of traditional monetary policy structures.

In addition, the increasingly digital financial landscape will catalyze transformative alterations in the mortgage landscape. Financial technology, or fintech, may produce tools and platforms that can further consolidate or complicate the relationship between mortgage rates and inflation. The introduction of blockchain technology in mortgage transactions or the rise of artificial intelligence in predicting interest rates could potentially disrupt traditional mechanisms and their established connections to inflation.

The complexity of the global political landscape is another substantial determinant in shaping this intricate relationship. Geopolitical strife, alterations in international trade policies, and structural shifts in prominent economies can induce fluctuations in inflation rates and indirectly impact mortgage interest rates. These include both micro-level occurrences, such as a single country’s political state, and macro-level phenomena, such as instances of economic recession or expansion.

The role of behavioral economics – the study of social, cognitive, and emotional considerations in decision-making – will become increasingly significant in the correlation between these two economic components. The expectations, emotions, and reactions of consumers and investors can sway macroeconomic conditions and carry implications for inflation rates and mortgage interest rates. This is especially vital as the world grapples with rapid changes and uncertainties brought about by events such as pandemics or climate change.

Furthermore, exceptional phenomena such as an inverted yield curve may disrupt the anticipated correlation between mortgage rates and inflation. While traditionally, long-term interest rates tend to exceed short-term rates, during times of economic uncertainty, the inverse may occur, indicating possible economic downturns. This unorthodox scenario can yield unprecedented patterns in the relationship between mortgage interest rates and inflation, requiring vigilant surveillance and reactive adaptation.

In conclusion, forecasting the future of mortgage interest rates and inflation is a complex endeavor. It requires a nuanced understanding of the myriad factors at play and how they interlink in unforeseeable ways. Only through continuous learning and resolute vigilance can we navigate this uncertain terrain and equip ourselves to respond effectively to the shifts borne in the flux of economic variables.

As we navigate through the intricate world of economics, we glimpse the intricate relationship between mortgage interest and inflation rates, marked by historical precedents and various socio-economic factors. With an integrated global economy, these reflections are indispensable, guiding us towards a better strategic understanding of inflation’s role in shaping mortgage interest rates. Crucially, these insights stimulate thought on the future of our economy, prompting discussions on policy adaptations to drive towards financial stability. Ultimately, this exploration emphasizes the undeniable influence of these two significant economic elements, underscoring their impact on our financial landscape.

Lian Jadepeak is a Chartered Financial Analyst (CFA) with a sharp acumen for investment strategies and financial markets. With a background in finance and years of experience in wealth management, Lian offers readers expert insights into smart investing, market trends, and portfolio management. Her clear, analytical approach helps demystify complex investment concepts for both seasoned and novice investors alike.